Student loan crisis affects Chapman faculty and students

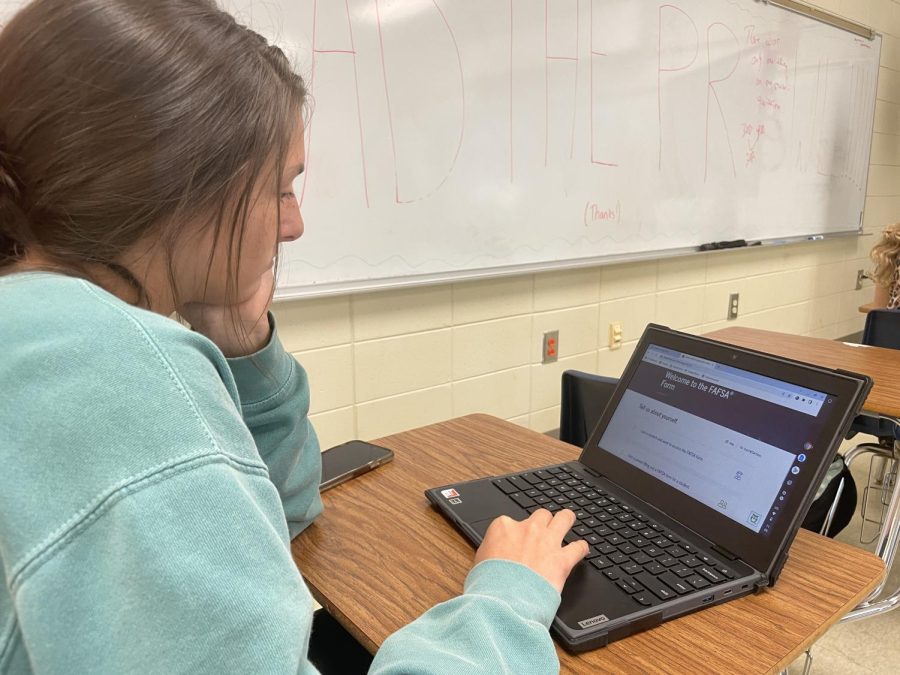

Senior Rylan Snead works on filling out her Free Application for Federal Student Aid (FAFSA) online. Snead will be attending College of Charleston.

The outstanding federal student loan portfolio currently sits at a whopping $1.611 trillion, with the average borrower’s balance at $37,113.

And this debt is weighing heavy on borrowers’ shoulders.

Many borrowers took out loans without fully understanding what that would look like in the future, particularly against the backdrop of 2008’s Great Recession and the COVID-19 pandemic.

“I don’t feel like I was adequately prepared with information about how this was gonna play out long term and how this was gonna affect my ability to pay bills in the early part of my career,” said English teacher Alex Hollis.

Fifty-three percent of millennials have not bought a home because student loan debt either disqualified them or made it impossible to afford a mortgage.

“If you’ve got student loans upwards of $100 a month, it can be difficult to buy housing that’s affordable because that’s also going through the roof,” said Assistant Principal Amy Driggers.

Although lenders often require some form of loan counseling, student loans are frequently disbursed to students and parents who may not have the financial literacy necessary to understand how the process works. This has been especially true as the cost of higher education has risen substantially in the last decade.

“Lenders made it very easy to borrow large sums of money without, I think, really having to go through the process of understanding what it means for the borrower,” said Driggers.

“I think many students are set up for failure because college is so expensive, and people just don’t have an understanding at that age of what it takes to pay back that kind of debt,” said Hollis.

A student who recently graduated high school and has no or very limited credit typically cannot borrow large sums of money. For example, it’d be unlikely for a new graduate to get a mortgage for a home.

However, those same students are able to take out large sums of money in the form of student loans.

“We don’t let young people walk out and do other things that are that obligatory without much more interference, so I don’t know why we allow that with student loans,” said Driggers.

This issue does not just affect students but also their parents; as parents are able to take out parental loans or personal loans, they can also co-sign their children’s loans.

“I have two children that have gone to college,” said math teacher Kelly Ackerman. “We did a lot of parent loans, and my kids are all grown up and living on their own, but not really because I’m still paying for their parent loans.”

The student loan crisis does not appear to be going away any time soon.

One option currently being discussed is student loan forgiveness for all borrowers. Some politicians favor total forgiveness of student loans, some favor partial forgiveness and some favor no forgiveness.

Social studies teacher Kimberly Ensley said that although she would appreciate student loan forgiveness, she recognizes that it’s not a perfect idea.

“I’d love to have my loans forgiven, but I’m not sure how realistic that is or how that would affect the economy,” Ensley said.

Ackerman is opposed to forgiveness.

“People talk about canceling debt, but that’s not right,” she said. “I borrow the money, I pay it back.”

That may be the traditional model of borrowing money, but some suggest the economic climate of the last several years makes that more difficult than it sounds.

“If we were all graduating college and going into jobs making six figures we probably wouldn’t be having this conversation, but most people are not,” Hollis said.

Instead of full or even partial forgiveness, some borrowers suggest that loan payments could be made simpler and easier with a small change.

“I do think there should be a cap on interest rates,” science teacher Brittney Feagan said.

But even if all student loan borrowers had their debt wiped today, many argue that will just happen again without proper precautions.

“I think it’s a crisis, but it’s a crisis we’ve got to start fixing from the front end,” said Driggers.

One suggestion is to increase the financial education that students receive in high school. Many schools do not offer or require courses in financial literacy. As a result, students enter life after high school with little knowledge or understanding of how to borrow, manage and repay money.

“I think we should definitely have financial literacy classes,” said Feagan. “I didn’t know how really any loan worked as far as interest and things like that. I have no idea how to do a mortgage at this point, and I’m 25 years old.”

Current high school students are aware of the financial challenges that face them if they choose to attend a college that includes tuition that will require student loans to be covered.

“They definitely need ways to tell people what they’re doing when it comes to student loans because I’m a high school student, and I don’t know anything,” senior Rylan Snead said.

Thanks to her parents’ help, junior Gabby Freire considers herself to be financially literate, but she said that a course centered around certain topics could still be helpful.

“It’s something that I think would be very valuable,” Freire said. “Obviously, something about taxes because taxes are something everyone has to file, but also just about saving money and how important it is to not go into debt, debit cards versus credit cards, and all the information that people need just to live stably.”

Of course, student loans, despite being common for many Americans, are not the only way to pay for college.

There is an abundance of scholarship opportunities and financial incentives available at certain schools for students.

“A big thing for me is that state schools give you a lot of money for just going in-state, but also I’m applying to schools that have high financial needs met,” said Freire.

Freire cited Vanderbilt University as one of the schools that seeks to help students pay for college without the added burden of tremendous student debt. According to Vanderbilt’s financial aid website, “Vanderbilt will meet 100% of a family’s demonstrated financial need.”

Not every student is bound for Vanderbilt; that doesn’t mean that there aren’t options available, however.

Driggers, who worked in financial aid at Spartanburg Methodist College before becoming an educator, encourages students to seek out all educational opportunities, including ones that may not take them to a four-year degree.

The benefits, she said, go beyond just the reduction in tuition and student loan debt.

“I think we neglect a lot of other opportunities like community college that have phenomenal programs that students can go in with a two-year certification and go into very well paid, productive, needed careers,” said Driggers.

Chapman does provide financial guidance for students.

In addition to scholarship announcements posted to places such as the senior Google Classroom, Chapman also hosts a financial aid night to help students and their families understand the financial aid process including how to fill out the Free Application for Federal Student Aid (FAFSA).

“We have someone from South Carolina student loan in Columbia come and talk to our seniors and their parents,” guidance counselor Carrie Pollard said. “They basically go through how to fill out the FAFSA, the different types of aid, and then they also go into if you have to use student loans, which ones are the best to use.”

Students can see guidance for more information on how to apply for scholarships, which can offset the amount of money that is necessary to borrow to attend college.

Given the struggles that student loans can place on students and the amount of scholarship opportunities available, Pollard urges students to explore all options before taking any out.

“Student loans need to be your last resource when it comes to paying for college,” she said.

Your donation will support the student journalists of Chapman High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.